Too much panic in the world can damage not only the environment or society but can also lead to big economic disasters. However, if it happens all at once, there’s something big going on. This can lead to a financial crisis. But what is a financial crisis, and how devastating were some economic collapses in history? When is the next financial crisis, or is it happening right now? And how to survive in a financial crash?

What is a Financial Crisis?

A financial crisis happens when assets drastically lose on value, and businesses and consumers are not able to pay their debts. And financial institutions experience liquidity shortages (lack of cash or convertible cash assets).

This leads to panic or a bank run where people and investors sell off assets or withdraw their money from their savings accounts because of the fear that the value of assets will drop if they remain in financial institutions.

Another situation that could happen is when a financial bubble bursts. That means when there is a belief, the assets´ price will continue to rise. It makes people pay more because they expect to sell their assets for more. When no investors are willing to buy at the evaluated price, it causes a massive sell-off that can make the bubble burst.

The stock market crash is also something that could lead to a financial crisis. This can occur if stocks rapidly drop over nine percent and suddenly in a few days drop in prices. A stock market crash can be a side effect of major catastrophic events, an economic crisis, or the burst of the above-mentioned bubble.

When a country’s government fails to repay its debts, it is known as Sovereign Defaults, which can result in a financial crisis.

The last is a currency crisis if a nation’s currency loses suddenly and drastically on value. It happens when the country has unstable markets, and there is a lack of faith in the nation’s economy.

While some financial crises may be limited to banks or single and region-based economies, it can also be a worldwide economic crisis.

The History of Financial Crises

Throughout history, there were a lot of different financial crises that happened for as long as the world had currency. While these crises are not uncommon but somewhere more-devasting financial crisis than others in modern times:

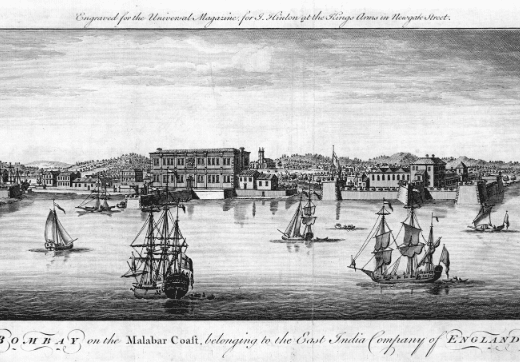

The credit crisis of 1772:

It started in London and quickly spread over the rest of Europe. The British Empire had gained a lot of wealth through its colonial possessions and trade. Which created overoptimism and rapid credit expansions of many British banks.

However, when Alexander Fordyce, a partner of a large bank, lost a huge sum of shares from the East India Trading Company and fled to France so he can escape his debt repayments.

The quickly spread news triggered a banking panic in England where creditors formed long lines in front of British Banks to demand instant cash withdrawals. Over 20 large banking houses become through this event, either bankrupt or stopped payments to creditors and depositors.

This crisis spread to other parts of Europe and the British American colonies. Many Historians believe it was the cause of the Boston tea party was the unpopular tax legislation in 13 colonies were decided this unrest was the main factor of American Evolution.

Stock Crash of 1929:

This crash started on Oct. 24, 1929, were share prices collapsed through a period of wild speculations and borrowing to buy shares. The Wallstreet market crash, wipe out a great deal of wealth from individuals and businesses.

It leads to the Great Depression, which was the greatest and longest economic recession in modern world history.

The event was felt all over the world and lasted over a dozen years. But the social impact lasted even longer. The result of this devastating event was a massive loss of income through record unemployment rates, especially in industrialized nations. Because of the crash, many regulations and market management tools were introduced.

The OPEC (Organization of the Petroleum Exporting Countries) Oil Crisis of 1973:

The organization primarily consisted of Arab nations who responded with an Oil Embargo after the United states send arms supplies to Israel during the fourth Arab Isreal war. An Embargo to stop exporting oil to the United States and its allies. It caused a major oil shortage, and a the end of the embargo, a barrel of oil increased in price from $3 to $12.

Because the modern economy depends on oil, the high prices led to a stock market crash and an economic crisis. The uniqueness was simultaneous; there was high inflation where prices of selected goods and services increased over a period of time. And Economic stagnation with little or no growth in the economy. It was named by economists “stagflation” and took several years to recover from it and to fall into pre-crisis levels.

The Asian Crisis of 1997-1998:

Speculative capital flows (money movement of investment trade or business production) created an era of optimism in many Asian markets, which resulted in overextension of credit and too much debt in these economies. In Thailand, the currency market failed because of the government’s decision no longer to have fixed exchange rates against the U.S dollar. A lack of foreign currency resources followed.

It started a wave of panic across Asian financial markets leading to a large foreign investment return of billions of dollars. Because of this panic, markets and investors became aware of possible bankruptcies of East Asian governments, which resulted in a worldwide fear of a financial meltdown. It took many years for things to return to normal. The crisis led to better financial regulation and supervision; for example, the International Monetary Fund stepped in with money and resource packages for affected countries to avoid default.

Financial Crisis of 2007-2008:

It started with a nationwide housing bubble in the U.S. Because home prices had been rapidly rising over the years, some even believed they would never stop going up. Many speculators bought and flipped houses, which made renters anxious to buy before they got priced out. Many mortgage brokers took advantage of the situation and offered subprime mortgages to house buyers with low credit rates who borrowed well beyond their means.

But the lenders did not hold onto those subprime loans and instead sold them for mortgage-backed securities (MBS are similar to bonds a bundle of home loans where Investors receive periodic payments). And for collateralized debt obligations (CDO is a finance product backed by a pool of loans and other assets). The problem was as the financial bubble burst, the last buyers were stuck, which were many of the biggest financial institutions in the United States.

Among them was one of the biggest investment banks in the world, Lehman Brothers, which brought many other important financial institutions and businesses to the brink of collapse. Huge government bailouts (money and resources) to limit the spread couldn´t avoid the damage, and the global economy fell into the Great Recession, which over millions of job losses and billions of dollars of income were wiped away. It was one of the worst crises since the Stock Market Crash of 1929.

When is the next financial crisis?

Money is where the government gives the paper the value, which is basically a contract between its user and the state. The promise is that the baker can exchange the banknote for something valuable. As long as everyone trusts the country to give notes, it is extrinsic value, not intrinsic value, like the weight of gold coins, once had.

Until 1972 the global economy relied on the gold standard where the American government had fixed rates to their currency like $35 per ounce of gold.

After the financial crisis of 1973, governments lost their confidence that the U.S. can maintain fixed rates between dollars and gold. So the U.S. concluded that the connection of gold was no longer necessary; it is why every other currency exchange rate are varying today. This point made every currency free from material value, and it can only be influenced by government monetary policies.

But the modern economy with freely floating currencies is under attack.

Financial warfare a strategy that is often used by criminals to profit and states to attack their enemies. For instance, Terrorists betted on the shared prices of airlines crashing after the 9/11 attacks, which is what happened, and they profited greatly.

Financial warfare can be offensive, like hacking into the stock market of a country to manipulate prices and cause economic damage. This happened in 2012 when the U.S attacked Iran by excluding them from global payment systems, so Iran couldn´t swap its currency for dollars or euros, which made it almost useless for trading.

The second financial warfare is defensive, where a capital market can be protected or used as revenge against states which attacked.

Iran defended itself by boosting up gold prices the month before the U.S offensive so they still could trade even if they were cut off from international payment systems.

In 2008 the seriousness of financial warfare was demonstrated in the financial crisis. Where bad mortgages could accidentally lead to economic losses $60 trillion. However, this is nothing against the damage that could be done by experts of the financial system that knowingly want to harm. It makes the global economic system very fragile and unsafe for such attacks, so even a small terrorist and criminal group could hugely damage all of society.

With this realization, the U.S. and China developed procedures for financial warfare along with traditional military forces.

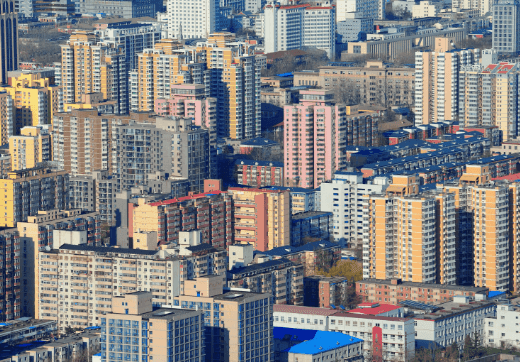

It was a long time since the la st financial crisis, but the upcoming disasters are around the corner. In China, a crisis could happen because of the drastic expansion in the last decades. Due to poorly planned growth with far too much investment in the wrong areas of society and massive corruption.

st financial crisis, but the upcoming disasters are around the corner. In China, a crisis could happen because of the drastic expansion in the last decades. Due to poorly planned growth with far too much investment in the wrong areas of society and massive corruption.

There are many unused cities with buildings, parks, and roads that no one can afford to use. This created an investment bubble that could burst and could put the whole global economy in danger of collapse because investors all over the world provided money to china and pointless projects.

But also in the U.S., a crisis could happen which has to do with student loans

Politicians love to give students more generous loans because they know they can rely on students to spend the money in the economy.

The U.S. government and several financial institutions currently have given out over $1 trillion in student loans. Unfortunately, students aren’t finding jobs after graduating because the U.S. economy is really bad. So they can’t pay back their student loans and which can result in a crash in financial markets.

How The Corona pandemic leads to a Financial crisis

However, what is happening now with the Corona Pandemic will most likely lead to a financial crisis. Despite the necessary responses from governments on strict social distancing, lockdowns, and financial policies. It will have lasting effects for years to come.

The crisis will not only affect businesses and employment around the world, but it also will bring large political and social changes. As companies in all industries shutting down for a least several month’s Factories are closing, shops, gyms, bars, schools, colleges, and restaurant

A question is when and how the COVID-19 public health crisis will be resolved. It is why economists cannot predict the damages that come from the financial sectors.

Even all the efforts by central banks and authorities to smaller the problems, the asset market in advanced economies already felt the damage. The capital drastically decreased in emerging markets at a breathtaking pace. It makes economic downfalls and financial crises unavoidable.

Even after the economic restart, the damage to business and debt markets is at record-breaking levels.

It will be difficult to get businesses to invest and hire, especially with an upcoming high tax bill they have to pay when it is all over.

The airline industry will experience one of the biggest impacts. Most airlines can go bankrupt when international flights are cut down also many employees will lose their job

Also, car industry markets will drop down as manufacturers of car tools and machinery are having delays from 1-3 months because of the manufacturing shutdown in china.

So the car industry won’t be able to launch their new annual vehicles on time, which is why they are missing out on billions of dollars worth of sales. If the car companies are seeing a drop in sales and revenue, the suppliers will also. If the suppliers get the same loose of income, also will all other automative industries suffer from it.

These sales drops will apply to almost every other industry in the world. Even if there is certainly no downfall in the next few weeks, it will certainly happen in the next 24 months. The biggest problem is that all industries add up at the same time.

While Governments Set up interest-free loans for small business help packages for different industries, it won´t prevent the slow down of the economy. Debt will increase at record levels, as we have never seen before. And the unemployment levels have already surpassed the financial crisis in 2008.

Is a Financial Crisis coming soon?

Even the best market analysts tend to have a limited ability to detect exactly when a financial crisis occurs. There is no reason to suppose that small business owners will be any better at detecting this economic transition.

It is too early to say we art at a turning point and long-lasting slowing of capital funds.

With inventory levels so low due mostly to the supply chain disruptions, companies need to continue to invest to rebuild inventory levels and technology to gain more productivity.

While business owners may hire less and do more work themselves, recruiting and retaining staff is necessary to increase sales as well.

These supply chain and labor market requirements add even more stress levels to small businesses, especially. It ultimately can make a real economic impact because the confined level of business owners impacts the investments and hiring decisions.

The problem is they are not seeing how the current environment is sustainable. Consumer spending is still strong, and GDP also. But the stress they feel in trying to absorb such cost and fill a position to increase compensation for recruitment and retention is incredibly stressful.

The economist Robert Fry, a respondent to CNBC’s Fed Survey, thinks that the recession does not hit until late 2023. He uses the work of a famous MIT economics professor Rudi Dornbusch: “A crisis takes a much longer time coming than you think, and then happens much faster than you thought.”

He views the current environment as still in a more negative state than actual negative data. These variables drive the state of the unemployment rate, the stock market, and gasoline prices. These aren’t average issues, people just see one at a time, and now it’s the gasoline prices.

Small business owners often share such a state. Fry thinks They don’t appreciate the lag of monetary policy. Small business owners usually define a recession as less academic and more as a reflection of how tough their current operating condition is and what it takes to recover from pre-pandemic levels to sustain their business through the next few years.

Inflation pressures margins and pushes back revenue. A longer timeline to full recovery puts everything at risk for small business owners. They feel like a recession is coming regardless of the formal economic research. Owners have to figure out a smart way through the crisis and not only put their heads down and try to survive by working more hours.

Also, Fed policies and the turbulence with the Covid and skyrocketing oil prices suggest we are near a financial crisis. Despite low unemployment, new job opportunities, and other signs of economic health, there are many warnings that a recession is coming if it isn’t already here.

What needs to happen to minimize Economic damages?

A comprehensive national safety net already exists to prevent bankruptcies and long-term financial damage. Nevertheless, many businesses and industries have too much debt and weak business models and taken too many risks get exposed, and can´t be saved anymore. It will cause many job and revenue losses.

It is necessary to make investments in public health infrastructure big and small, like hugely improved surveillance and emergency facilities, as well as substantial reserve capacity.

This will offer excellent opportunities to productively spend money and create high-quality jobs.

As banks print money more than ever, it causes things like inflation with a price increase of many products and services. Printing won´t expand the economy and make it healthier in the short term it causes the currency becomes less and less valuable in the long term

The current dollar-backed global financial system is in big trouble. An option would be to turn to the International Monetary Fund (IMF) which already lends funds to countries that desperately need financial support. For lending, the IMF uses its own quasi-currency, the Special Drawing Rights (SDR).

It´s not an official currency, but the SDR functions similarly: it holds the value of major world currencies that can be swapped between countries and exchanged for other currencies. The SDR functions like a currency and is more stable than the dollar, so it can replace it as the global reserve currency.

An important benefit would be the SDR would be determined by the IMF, which is an international entity that makes decisions based on what is good for the entire world. Because currently, the U.S. decides its monetary policy for the dollar based on its interests, which can hurt other countries economically. While this is already in discussion now would be the right moment, as the monetary system gets more and more unstable and unpredictable, which is in nobody’s interest.

The problem is there is no stable reference point an anchor for their value. While many currencies are not backed up by anything solid only by the promise of the government and central bank that it has value.

How to survive in a financial crisis?

Online Business and Content creation are rising now more than ever as many stay at home and want to entertain or educate themself. This brings many chances to make money in this crisis at home, especially if you lost your job. This crisis will most likely create more wealth through social media and blogging than it will for most other industries. Also, streaming platforms and Gaming industries are growing more and more.

While many restaurants are closed more delivery services are needed and which offers many new job opportunities

Even when life turns back to normal, there maybe will still be many people from now on, only ordering deliveries. It will hurt many small retail shops even more after the end of the lockdown.

When you save up a little bit of money that you can use for investment now is a good time to look for investment ideas:

- buying Cryptocurrency, that can increase in value when other currencies are losing big

- Investing stocks that are important for the future.

- The Real estate market offers big opportunities if you can afford them. Unfortunately, many owners need to sell their homes as they can´t pay their mortgages anymore.

- Valuables like paintings and sculptures or gold can be another option to invest in.

- Finally, make sure to keep about 30 % in cash in the bank or Tresor; it is the most flexible instrument to hold.

But even if you don´t save enough money now, you should definitely start with saving money to survive this crisis and beyond.

The whole world will feel the damage to the economic society and the environment. But what matters is how people businesses and governments respond to health care and hospital problems and other industrial issues that happen right now. Only if the world works together and improves in the right direction for a sustainable future, we are better prepared for an upcoming crisis, pandemics, and natural events.

What do you think will a financial crisis happen, and are you prepared?